Aggregate Demand is the total output that is demanded at each price level holding all other variables constant. The relationship between the level of demand and the aggregate price level is shown by an aggregate demand curve which is usually downward sloping. This means that a lower price level will result in a greater aggregate quantity of goods and services demanded. Mathematically aggregate demand is given by the identity:AD = C + I + G + X - Mi.e. aggregate demand is the sum of consumer spending,

investment, government expenditure and net exports (X-M)

Ref: Turley G. and Maloney M., ‘Principles of Economics: An Irish Textbook’ Second Edition

2.Animal Spirits

Animal Spirits is a term closely related to John Maynard Keynes who used it to describe the idea that aggregate economic activity may be partly driven by waves of optimism and pessimism. Essentially Keynes was saying that confidence sometimes played a part in determining economic prosperity.

Example: When consumers are confident about the future state of the economy they are likely to increase spending. Increased consumer spending which is magnified by the multiplier effect will increase aggregate output.

3.Bank Run

A bank run occurs when customers fear that a bank will become insolvent and rush to remove their deposits from the bank.

Example: A recent example of a bank run is the situation involving Northern Rock. A large number of customers removed their deposits when Northern Rock announced it had received emergency funding from the Bank of England. The actions of the customers almost resulted in the failure of the bank.

4.Bond

A bond is a debt security in which the bond issuer owes the bond holder an amount of money called the principal and the issuer is obliged to repay the holder the principal plus interest(also called the coupon) at a specified future date called maturity.

Example: A bond is simply a loan. In the case of a mortgage, a bank can be regarded as the bond holder and the borrower can be regarded as the bond issuer. Interest paid is equivalent to the coupon.

5.Capital Account

The part of the balance of payments that records a nation's incoming and outgoing investment flows, such as payments for parts of or entire companies (direct or portfolio investment), stocks, bonds, bank accounts, real estate and factories.

Example: Ireland’s Capital Account deficit for the financial year 2007 was 8,616 million euro compared to 6,804 million in 2006.

6.Debt to GDP ratio

A country’s debt to GDP ratio is calculated by dividing national debt by Gross Domestic Product (GDP). The ratio is a measure of a country’s ability to repay its debt.

Example: Ireland’s debt to GDP ratio has fallen from over 90% in the early 1990’s to an estimated 25.1% in 2007.

7.Effective Demand

Effective Demand is an economic principle that suggests consumer needs and desires must be accompanied by purchasing power in order to be considered ‘effective’ or relevant in determining demand and supply and in turn price.

Example: A consumer with a low income may have a strong desire to purchase an expensive sports car but will not have enough money to purchase one. In order for this consumers’ demand to be ‘effective’ he must be willing and able to pay for the car.

8.Deflation

Deflation is the persistent decrease in the general price of goods or services over a period of time. There are four causes of deflation.

· Decrease in demand for goods/services

· Increase in supply of goods/services

· Decrease in spending power

· Increase in demand for money

An increase in the supply of goods/services can be caused by capitalism where as industry improves and competitors increases, the supply of goods and services increases meaning that prices must fall to balance the demand. A decrease in the spending power of a population can also lead to deflation as the demand for goods and services will decrease, industry will suffer due to losses and the consequences of this (job losses, interest rate increases) will fuel the deflation. Deflation can benefit or hinder an economy depending on the cause. An increase in supply of goods for example could lead to increased spending power which could drive industry. A decrease in the spending power however can have cyclical effects and has devastating effects on an economy.The great depression in the US was an example of deflation. Spending power in the US decreased affecting industry. Consumer and wholesale prices fell from between 25% and 35%.

9.Consumption Function

The consumption function calculates the amount of total consumption in an economy. It emphasizes the relationship between consumption and income.

It calculates it as being :

C = a +c*Yd

Where a is the autonomous consumption, c is the marginal propensity to consume and Yd is the disposable income. Autonomous consumption represents consumption when there is zero income. Marginal propensity to consume is a measure of how likely someone is to consume. Consumption based on income is therefore a fraction of disposable income and the factor affecting what fraction is the mpc. Future potential income is not a factor in the consumption function.

Demonstrating an example of this: If my disposable income was 20,000 euro, my marginal propensity to spend was .4 and my autonomous consumption was 2,000, using the above formula we can see that my consumption according to the consumption theory is

C = 2,000 + (.4)*20,000 = 10,000

10.Consumer Price Index

A consumer price index or CPI, measures the average price of goods/services purchased by a household. It is a national economic statistic from which the rate of inflation can be measured as an annual percentage change in the price index. It is therefore known as an inflationary indicator.The average price is based on a fixed basket of good and services. The consumer price index is also known as the cost of living.

An example of this could be seen in Ireland over the past number of years where the cost of living has increased. Dublin is now ranked the 8th most expensive city in to world in which to live. The CPI rose to 4.9% in 2007. Food prices have been shown to be the major culprit in this increase.

11.Investment Function

The investment function shows the relationship between changes in national income and the investment patterns in an economy.

Example:If the national income increases and you find yourself with an increased wage for example, the investment function studies the effect of this on your investment tendencies. So taking a simple example of the investment function, holding interest rates and other economic factors constant, the increase in wealth of the individual would lead to an increase in their propensity to invest.

12.Fiscal Expansion

Fiscal expansion is an increase in government spending due to fiscal policy brought about to affect an economy. Fiscal policy is said to be expansionary when government spending is higher than revenue. This adds directly to aggregate demand or indirectly if the expansion is due to reduced taxes. This would cause an increase in household’s disposable income and presumably an increase in consumption. This in turn raises aggregate demand.

An example of fiscal expansion can be seen currently in the US where the US Federal Reserve cut interest rates by 1.25% in an aim to provide a fiscal stimulus.

13.GDP Deflator

The GDP deflator is a measure of the change in price of domestically produced goods and services. GDP is the gross domestic product which is the total value of final goods and services produced in an economy. The deflator is not calculated based on a fixed basket of goods/services like the Consumer Price Index and therefore reflects new goods and services. It is calculated as follows:

GDP Deflator = (Nominal GDP/Real GDP) * 100

As seen in the above formula, dividing the nominal GDP by the deflator produces the Real GDP. It shows how much a change in a year’s GDP is influenced by changes in the price level. Example – A GDP Deflator value of 102 would show a 2% increase in the GDP.

14.Imports

Imports are the purchase of foreign goods and services and are therefore goods or services provided to domestic consumers by foreign producers.

A simple example of an import would be an American importing some traditional Irish produce such as denny’s meat produce. Ireland is the 12th largest import source for the US.

15.Monetary Contraction

Monetary contraction policy is when the Federal Reserve is using its tools to put the brakes on the economy to prevent inflation.This usually means raising the Fed Funds rate to decrease the money supply. This will cause mortgage rates to increase, consumers to borrow and spend less, and businesses to stop raising prices and giving raises. This usually heads off inflation.

e.g. Dodge line is a financial and monetary contraction policy drafted by Joseph Dodge for Japan to gain economic independence after the World War II. It was announced on March 7, 1949.

1) Making the national budget balance to reduce inflation.

2) More efficient tax collection.

3) Dissolve the Reconstruction Finance Bank because of its uneconomical loans.

4) Decrease the scope of government intervention.

5) Fix exchange rate to 360 yen to the US dollar to keep Japanese export prices low.

(Kimberly Amadeo, the publisher of WorldMoneyWatch.com, How Would the Fair Tax Impact the Economy?)

(James D. Savage, University of Virginia, The Dodge Line and the Balanced Budget Norm in Japan)

16.Nominal GDP

The nominal GDP is a gross domestic product (GDP) figure that has not been adjusted for inflation. Also known as "current dollar GDP" or "chained dollar GDP".

i.e. It can be misleading when inflation is not accounted for in the GDP figure because the GDP will appear higher than it actually is. The same concept that applies to return on investment (ROI) applies here. If you have a 10% ROI and inflation for the year has been 3%, your real rate of return would be 7%. Similarly, if the nominal GDP figure has shot up 8% but inflation has been 4%, the real GDP has only increased 4%.

(Reem Heakal, Macroeconomic Analysis)

17.Propensity to consume

The average propensity to consume is the proportion of income the average family spends on goods and services. (Mike Moffatt, Who Pays the Highest Marginal Tax Rates?)A component of Keynesian theory, the marginal propensity to consume (MPC) says by how much consumption rises if income rises by one unit.

e.g. Suppose you receive a bonus with your paycheck, and it's $500 on top of your normal annual earnings. You suddenly have $500 more in income than you did before. If you decide to spend $400 of this marginal increase in income on a new business suit, your marginal propensity to consume will be 0.8 ($400 divided by $500).

18.Short run

A period of time in which the quantity of some inputs cannot be increased beyond the fixed amount that is available.

e.g. What quantity of inventory to order is a short run decision. Whether or not to build a new factory would be considered a long run decision.

19.Real exchange rate

The real exchange rate is the ratio between the price of a (bundle of) good(s) abroad and at home.

e.g. If the

real exchange rate of the French franc falls below purchasing power parity, it is cheaper to buy imported goods: French people will buy Rovers rather than Citroens, enjoy Cheddar and Chester over Roquefort and Brie, and eventually, although the exchange rate would have to be very low, they may even switch to drinking British wine. Adding all these things up, French imports from Britain rise as the exchange rate falls. The opposite occurs if the real exchange rate goes up.

(Manfred Gartner, A Primer in European Macroeconomics)

20.Trade surplus

Trade surplus is a positive balance of trade. i.e. Exports exceed imports, opposite of trade deficit.

e.g. China shocked much of the world last year(in 2005) when it reported that its global trade surplus had more than tripled to $102 billion or 4.5% of revised gross domestic product.

(Stephen Green, China's Trade Surplus May Be an Illusion, MAY 22, 2006)

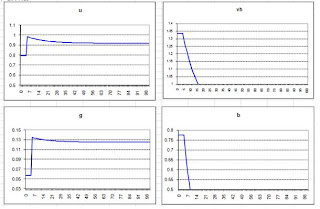

The specification of the consumption function in SIM is different and consumption is a function of stocks and flows. Consumption is calculated as some proportion alpha one of the flow of disposable income plus a smaller proportion alpha two of the stock of wealth from the previous period.

The specification of the consumption function in SIM is different and consumption is a function of stocks and flows. Consumption is calculated as some proportion alpha one of the flow of disposable income plus a smaller proportion alpha two of the stock of wealth from the previous period.  A version of SIM that replicates the ISLM could be created by allowing consumption to be a function of autonomous consumption (which is independent of current income), the marginal propensity to consume and disposable income only as the ISLM model does not consider stocks such as the stock of money.

A version of SIM that replicates the ISLM could be created by allowing consumption to be a function of autonomous consumption (which is independent of current income), the marginal propensity to consume and disposable income only as the ISLM model does not consider stocks such as the stock of money.

After

After